Retirement planning for the self-employed (part 2)

This week we’ll pick up on the topic of your government pension, and how working while you are receiving it can change the total amount.

CPP and OAS don’t change if you earn extra income, but GIS does. So we will examine how working can affect the amount of GIS you receive.

The GIS Clawback rule

If you work while receiving your government pension, your GIS, if you receive any, will be reduced. By how much depends on the total income you receive in retirement.

(Bear in mind, income means CPP + private pension + employment/self-employment income, plus any other income you might receive. OAS is not counted as income.)

The first $5,000 of your retirement income is exempt, so there is no affect on your GIS. For the next $10,000, GIS is clawed back at 50%. Any income over that is clawed back dollar for dollar.

So if you earn $20,000 in income, $5,000 is exempt, leaving $15,000. The next $10,000 of that causes your GIS to be clawed back by 50% of that amount = $5,000. That leaves $5,000, which is clawed back at 100%. That means of the total $20,000, you basically get to keep. $10,000.

That may sound like bad news, but let’s look at it from a different angle: you can earn income and also get some GIS on top of that. The higher your income, the less you receive from GIS. So, if your total annual income is $10,000, you might get $10,000 per year in GIS. If your income goes up to $20,000, you might get $5,000 in GIS. That’s just a hypothetical example, and exact amounts depend on your situation (whether you are single, married, how old you are, etc.)

The more GIS you are initially allowed, the more income you can earn before your GIS reaches the point where it is clawed back at 100%. This is why some financial planners suggest that taking early CPP might benefit you if you are expecting a low CPP, and you plan on continuing to work. It’s because your GIS will be larger. Remember, lower CPP may lead to higher GIS payments. The larger your GIS, the more income you can earn in employment/self-employment and still get some money from GIS.

Examples

Let’s look at a couple of examples to see how all of this adds up.

For these examples, I determined the amount of GIS by running examples through the Government GIS calculator. It’s a quick online tool that lets you estimate how much you might expect to receive. (I’ll give you the link at the end of the article.)

Example 1 – average CPP, no employment/self-employment

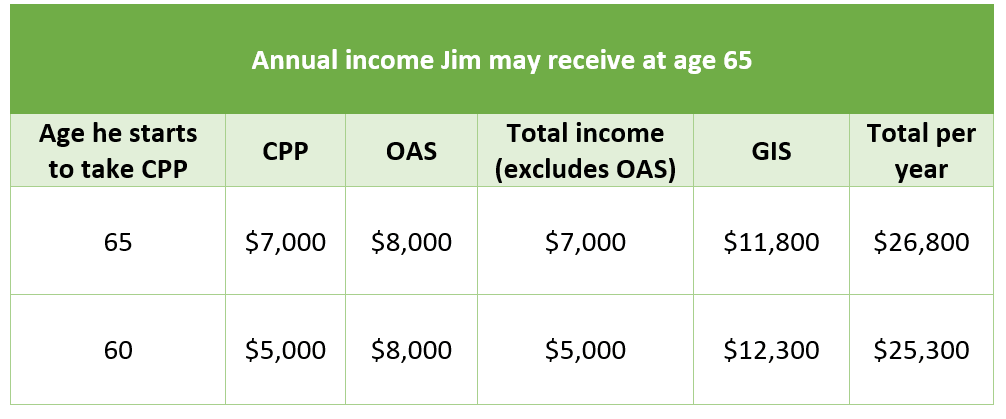

Jim has lived all of his life in Canada. He will receive $7,000 per year in CPP if he starts taking it at age 65. He will receive $5,000 if he begins taking it at age 60. He will have no other income at retirement (no company pension plan, no self-employment, etc.)

The following chart shows two scenarios. Both reflect his income at age 65, but one shows what his income will be if he starts taking his CPP at age 65, the other if he elects to start taking it at age 60.

In Jim’s case, taking his CPP early only reduces his total annual government pension amount at age 65 by $1,500 per year. But he will have also received a total of $25,000 in CPP payments between the age of 60 and 65 ($5,000 x 5 years = $25,000).

Example 2 - high CPP

Lauren has also lived her whole life in Canada. She will receive $12,000 per year in CPP if she starts taking it at age 65. She will receive $10,000 if she begins taking it at age 60. She also is expecting to have no other income in retirement except her government pension.

In Lauren’s case, taking her CPP early results in her receiving $1,300 less per year from the government. Between the age of 60 and 65, she will also have earned $10,000 x 5 years = $50,000.

What if you have higher retirement income?

Let’s take a look at another example, this time for someone who will receive a company pension in addition to their government pension.

Example 3 – high CPP with extra income

Hilda has also lived her whole life in Canada. She will receive $12,000 per year in CPP if she starts taking it at age 65. She will receive $10,000 if she begins taking it at age 60. She also is expecting to receive about $15,000 per year from a company pension.

She will receive about $1,000 less if she decides to start her CPP at age 60. And between age 60 and 65 she will earn $10,000 x 5 years = $50,000.

Only Hilda (or Jim, or Lauren, or you) can decide when they/you should start taking CPP. In Hilda’s case, if she waits until age 65, her total annual income at that point will be $40,000, instead of $38,500, a difference of $1,500 per year from age 65 on. If she decides to start taking her CPP at age 60, she will have a slightly lower annual income after age 65, but will have earned $50,000 in those 5 years. Perhaps she has arthritis, and knows it will only get worse, so wants to take advantage of the next few years in her life to do as much travelling as she can. That extra $50,000 might make that possible.

On the other hand, perhaps she comes from a line of long-lived ancestors, and expects to live to 100. That means she has many years of retirement that she needs to finance. If she waits until age 65 to start her CPP, then that extra $1,000 per year x 35 years = $35,000. Not a benefit in her case, since the $50,000 she would earn between 60 and 65 is greater than that. But for some, especially those with lower total retirement income, it might make a bigger difference, with greater total gains if you wait until age 65.

Example 4 – low CPP, plus employment/self-employment income

Thomas has lived all of his life in Canada. If he starts his CPP at age 65, it will be $5,000 per year. If he starts at age 60, it will be $3,000. He has no company pension. He will continue to work at his self-employment after retirement.

First, let’s look at his totals if he doesn’t do any self-employment after retirement.

In his case, since his CPP is so low, taking it early makes no difference in how much he will receive. So it might be advantageous for him to start at age 60, with that extra five years earning him $3,000 x 5 years = $15,000.

Now let’s look at some scenarios for Thomas if he earns various amounts of self-employment income.

(Note: The above chart does not take into account the extra money that would be earned from age 60 – 65 if he starts his CPP early.)

The main takeaway is this: the larger your GIS, the more income you can make and still get some GIS on top of that.

I know that’s a lot of numbers, but if you are anywhere near 60, I think it’s worth examining them closely, and then taking the time to work out your own scenarios.

* * *

I hope this and last week’s article have given you a good insight into how the Canadian government pension system works, and how continuing to work may affect the total you receive.

All of the examples used are, of course, hypothetical, and I’ve rounded the numbers for ease of doing the math. I also assumed each person in the example was single.

There are many factors that may affect the actual GIS you might receive. And once again I remind you that I am not a financial planner, so take what’s in this and last week’s article as a general overview, not as hard facts. I’ve done the best I could to make sense of the whole pension system and how it works, but make sure you do your own research to determine how it all works (because, hey, I’m human).

Why not give the online GIS calculator tool a try? You will need to know approximately how much CPP you can expect, which you can find out on your My Service Canada account (you can create one if you don’t already have one).

Here are the links for those tools.

Happy retirement planning!

Cheers,

Tim

Helping you engineer the business of you

Information in this article is for general purposes and is not intended as professional advice.